Bitumen, a dense and viscous form of petroleum, plays a pivotal role in the global infrastructure landscape. Primarily utilized in road construction, roofing, and waterproofing, its significance has grown in tandem with urbanization and industrialization. The global demand for bitumen is intricately linked to economic development, particularly in emerging economies where infrastructure expansion is a priority.

Bitumen production is predominantly concentrated in countries with vast oil reserves and advanced refining capabilities. These nations not only cater to domestic needs but also engage in international trade, influencing global supply chains. Understanding the dynamics of bitumen production offers insights into broader economic trends and the challenges associated with sustainable development.

This article delves into the multifaceted world of bitumen production, examining its global output, regional variations, and the leading countries in production. By analyzing statistical data and production trends, we aim to provide a comprehensive overview of the current state and future prospects of the bitumen industry.

Global Bitumen Production

As of 2025, global bitumen production is estimated at approximately 92.5 million tons annually. This figure underscores the material’s integral role in infrastructure development worldwide. The production landscape is dominated by a select group of countries, each contributing significantly to the global supply.

Leading Producers

- China: With an estimated Bitumen production of 34.55 million tons, China stands as the largest producer of bitumen. State-owned enterprises like CNPC and Sinopec spearhead this output, driven by extensive infrastructure projects under initiatives such as the Belt and Road Initiative.

- United States: The U.S. produces approximately 20 million tons of bitumen annually. Major corporations, including ExxonMobil and Marathon Petroleum, dominate the sector, with production concentrated in regions like Texas and Alberta.

- Canada: Canada’s oil sands, particularly in Alberta, contribute to an annual production of 12.5 million tons. Companies like Suncor Energy and Syncrude Canada are pivotal in this sector. Recent projections indicate a 15% increase in oil sands production by 2030, emphasizing the growing importance of bitumen in Canada’s energy portfolio. (Reuters)

- Iran: Iran’s Bitumen production stands at 7.5 million tons, with the Pasargad Oil Company being a significant player. Despite facing international sanctions, Iran continues to maintain a substantial share in the global bitumen market.

- Saudi Arabia: Saudi Aramco leads in Saudi Arabia’s production of 6.8 million tons. The nation’s vast oil reserves and advanced refining infrastructure bolster its position as a key bitumen producer.

Production Trends and Factors Influencing Output

Several factors influence global bitumen production:

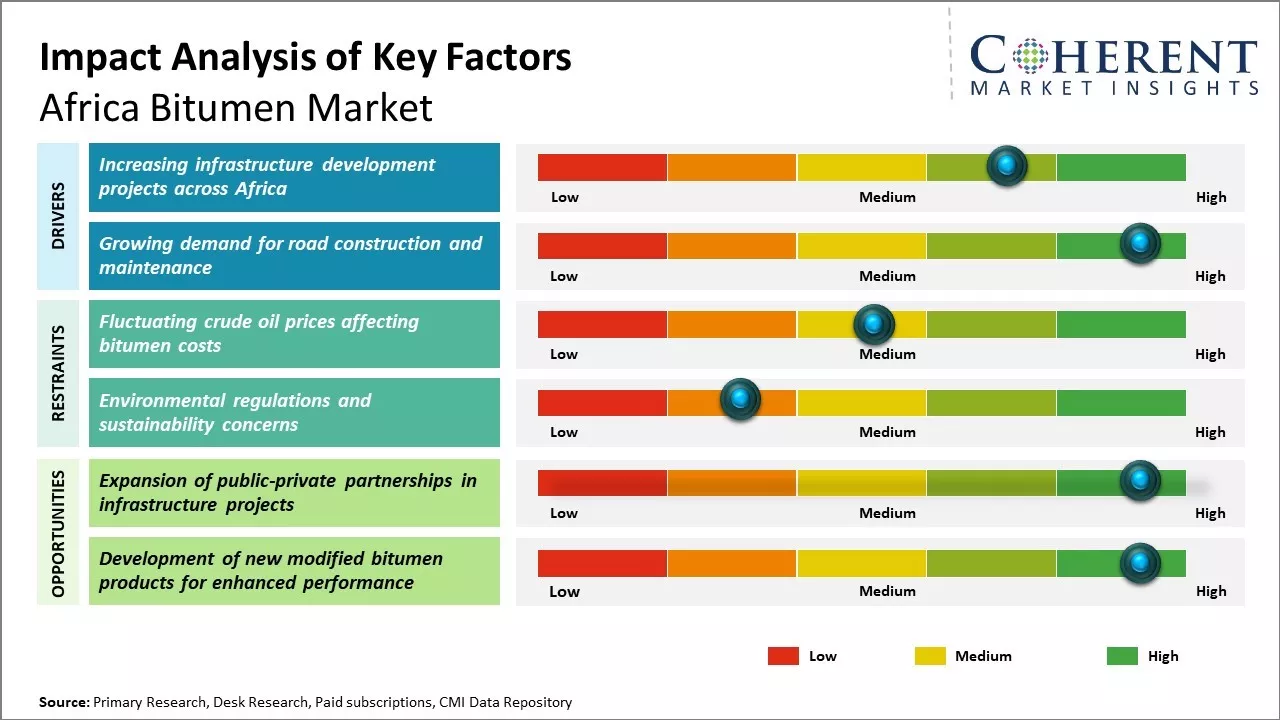

- Infrastructure Development: Countries investing heavily in infrastructure, such as China and India, drive demand for bitumen. China’s Belt and Road Initiative and India’s Bharatmala Pariyojana are prime examples of projects fueling this demand.

- Technological Advancements: Innovations in extraction and refining processes have enhanced production efficiency, allowing countries to meet growing demands.

- Environmental Regulations: Stricter environmental policies in regions like Europe have led to the adoption of sustainable production practices, influencing global supply chains.

- Market Dynamics: Global economic conditions, trade policies, and geopolitical factors can impact production levels and distribution networks.

Challenges in Production

Despite the robust growth, the bitumen industry faces several challenges:

- Environmental Concerns: The extraction and processing of bitumen production, especially from oil sands, have significant environmental impacts, including greenhouse gas emissions and land degradation.

- Supply Chain Constraints: Logistical issues, such as pipeline capacity limitations, can hinder the efficient distribution of bitumen. For instance, Canada’s oil industry faces pipeline constraints despite the expansion of the Trans Mountain pipeline. (Reuters)

- Market Volatility: Fluctuating global oil prices can affect the profitability and sustainability of bitumen production ventures.

Future Outlook

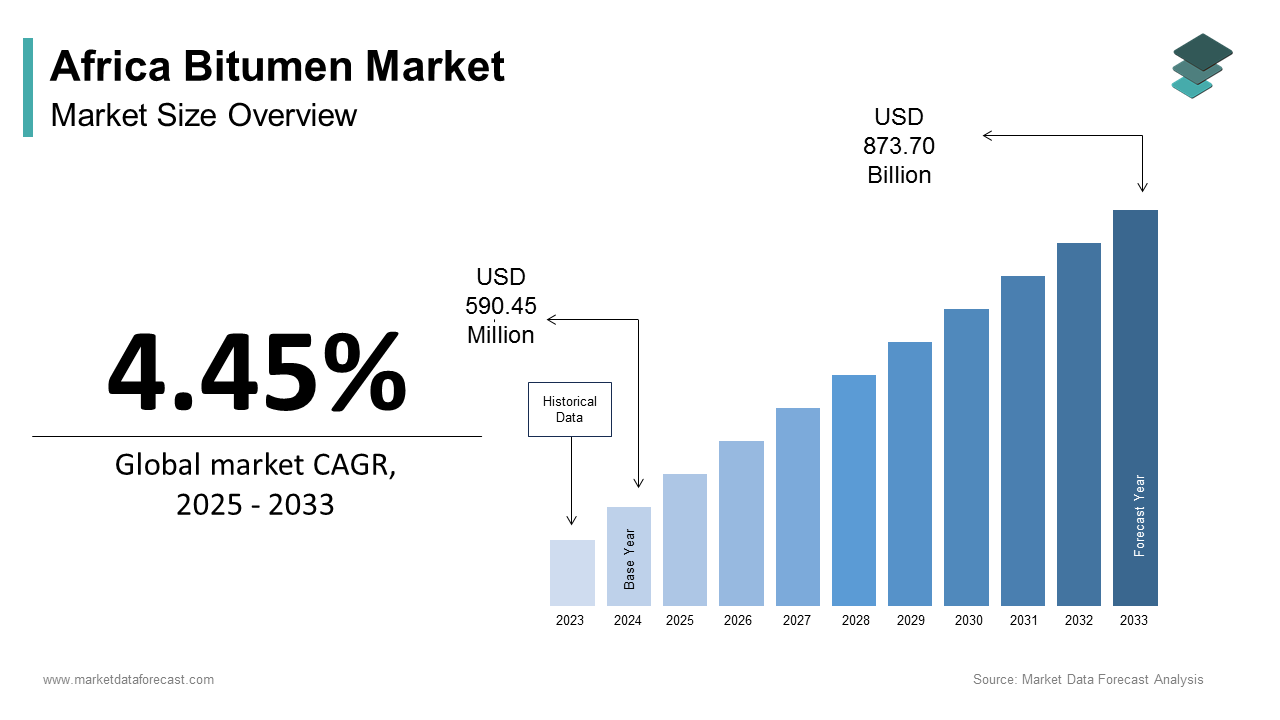

The global bitumen market is projected to experience steady growth:

- Asia-Pacific: Dominating the market, Asia-Pacific consumed over 45 million metric tons in 2023, with China accounting for more than 16 million metric tons. The region’s demand is driven by extensive infrastructure projects and urbanization. (Market Growth Reports)

- Middle East & Africa: This region consumed over 10 million metric tons in 2023, with Saudi Arabia and the UAE contributing significantly. Development initiatives like NEOM and Dubai’s transport expansions are key drivers.

- North America: The U.S. and Canada continue to be major players, with projections indicating growth in production and consumption due to ongoing infrastructure investments.

In conclusion, global bitumen production is poised for continued growth, influenced by infrastructure development, technological advancements, and market dynamics. However, addressing environmental concerns and supply chain challenges will be crucial for sustainable growth in the industry.

Bitumen Production by Continent

The global Bitumen production market is characterized by significant regional disparities in production and consumption, influenced by factors such as infrastructure development, economic activities, and technological advancements.

Asia-Pacific

Asia-Pacific stands as the dominant region in global bitumen production, accounting for approximately 35% of the total market share. In 2023, the region consumed over 45 million metric tons of bitumen, with China leading at over 16 million metric tons. India followed with more than 12 million metric tons, driven by extensive expressway construction and urban development projects. Southeast Asian countries like Vietnam, Thailand, and Indonesia collectively consumed over 5 million metric tons, reflecting their growing infrastructure needs. The demand for polymer-modified bitumen is also on the rise, particularly in urban road construction and expressway projects. (Market Growth Reports)

North America

North America holds a 28% share of the global bitumen market, with the United States being the largest consumer. In 2023, the U.S. consumed over 20 million metric tons, primarily for state-funded highway reconstruction projects. Canada followed with 3.2 million metric tons, focusing on road maintenance in provinces like Ontario and Alberta. The region has seen a growing interest in bitumen emulsions and polymer-modified bitumen, accounting for more than 28% of total bitumen usage. Additionally, the U.S. leads in recycled asphalt pavement (RAP) utilization, recycling over 45 million tons of asphalt annually, which contributes to saving approximately 9 million metric tons of new bitumen. (Market Growth Reports)

Europe

Europe contributes about 22% of the global bitumen demand, with countries like Germany, France, and the United Kingdom leading the market. In 2023, the region consumed approximately 18 million metric tons of bitumen. The European market has increasingly shifted toward cold-applied and recycled bitumen variants, driven by stringent environmental regulations and a focus on sustainability. For instance, over 1,000 smart infrastructure pilot projects utilizing sensor-integrated bitumen roads were recorded in 2023. Bitumen is also widely used in high-performance roofing systems in Nordic countries due to its resistance to ice and snow accumulation. (Market Growth Reports).

Middle East & Africa

The Middle East & Africa region holds an 8% market share in the global bitumen industry. In 2023, the region consumed over 10 million metric tons of bitumen. Saudi Arabia and the United Arab Emirates contributed over 4 million metric tons, fueled by mega projects like NEOM and Dubai’s transport expansions. In Africa, countries like Nigeria and South Africa are the top consumers, with demand reaching 4.5 million metric tons. The African Continental Free Trade Area plan led to the construction of 25,000 kilometers of new roads in 2023, driving the demand for bitumen. Sub-Saharan Africa experienced an 18% growth in bitumen demand, particularly for rural and inter-city road connectivity supported by development funding. (Market Growth Reports)

Latin America

Latin America represents approximately 7% of the global bitumen industry. Countries like Brazil, Mexico, and Argentina are the primary consumers, driven by public infrastructure spending and road improvement initiatives. In 2023, Brazil consumed over 1.2 million metric tons of bitumen, with a projected growth rate of 3.0% CAGR through 2034. The region is witnessing an increasing demand for bitumen due to expanding road networks and infrastructure activities. (Allied Market Research).

Bitumen Production by Country

As of 2025, global bitumen production is estimated at approximately 92.5 million tons annually. This figure underscores the material’s integral role in infrastructure development worldwide. The production landscape is dominated by a select group of countries, each contributing significantly to the global supply.

Leading Producers

- China: With an estimated production of 34.55 million tons, China stands as the largest producer of bitumen. State-owned enterprises like CNPC and Sinopec spearhead this output, driven by extensive infrastructure projects under initiatives such as the Belt and Road Initiative.

- United States: The U.S. produces approximately 20 million tons of bitumen annually. Major corporations, including ExxonMobil and Marathon Petroleum, dominate the sector, with production concentrated in regions like Texas and Alberta.

- Canada: Canada’s oil sands, particularly in Alberta, contribute to an annual production of 12.5 million tons. Companies like Suncor Energy and Syncrude Canada are pivotal in this sector. Recent projections indicate a 15% increase in oil sands production by 2030, emphasizing the growing importance of bitumen in Canada’s energy portfolio. World ranking sites

- Iran: Iran’s production stands at 7.5 million tons, with the Pasargad Oil Company being a significant player. Despite facing international sanctions, Iran continues to maintain a substantial share in the global bitumen market.

- Saudi Arabia: Saudi Aramco leads in Saudi Arabia’s production of 6.8 million tons. The nation’s vast oil reserves and advanced refining infrastructure bolster its position as a key bitumen producer.

Production Trends and Factors Influencing Output

Several factors influence global bitumen production:

- Infrastructure Development: Countries investing heavily in infrastructure, such as China and India, drive demand for bitumen. China’s Belt and Road Initiative and India’s Bharatmala Pariyojana are prime examples of projects fueling this demand.

- Technological Advancements: Innovations in extraction and refining processes have enhanced production efficiency, allowing countries to meet growing demands.

- Environmental Regulations: Stricter environmental policies in regions like Europe have led to the adoption of sustainable production practices, influencing global supply chains.

- Market Dynamics: Global economic conditions, trade policies, and geopolitical factors can impact production levels and distribution networks.

Challenges in Production

Despite the robust growth, the bitumen industry faces several challenges:

- Environmental Concerns: The extraction and processing of bitumen, especially from oil sands, have significant environmental impacts, including greenhouse gas emissions and land degradation.

- Supply Chain Constraints: Logistical issues, such as pipeline capacity limitations, can hinder the efficient distribution of bitumen. For instance, Canada’s oil industry faces pipeline constraints despite the expansion of the Trans Mountain pipeline. Reuters

- Market Volatility: Fluctuating global oil prices can affect the profitability and sustainability of bitumen production ventures.

Future Outlook

The global bitumen market is projected to experience steady growth:

- Asia-Pacific: Dominating the market, Asia-Pacific consumed over 45 million metric tons in 2023, with China accounting for more than 16 million metric tons. The region’s demand is driven by extensive infrastructure projects and urbanization. World ranking sites

- Middle East & Africa: This region consumed over 10 million metric tons in 2023, with Saudi Arabia and the UAE contributing significantly. Development initiatives like NEOM and Dubai’s transport expansions are key drivers.

- North America: The U.S. and Canada continue to be major players, with projections indicating growth in production and consumption due to ongoing infrastructure investments.

In conclusion, global bitumen production is poised for continued growth, influenced by infrastructure development, technological advancements, and market dynamics. However, addressing environmental concerns and supply chain challenges will be crucial for sustainable growth in the industry.

Conclusion

Bitumen production is a critical component of global infrastructure development, reflecting the dynamic interplay of economic growth, technological advancement, and regional demands. Globally, the production volume is robust, with Asia-Pacific leading the market due to rapid urbanization and massive infrastructure projects, especially in China and India. North America and Europe follow closely, driven by sustained investments in highway maintenance and innovation in sustainable bitumen products.

Regionally, significant disparities exist, with emerging markets in the Middle East, Africa, and Latin America experiencing rapid growth due to increasing infrastructure needs and development initiatives. Leading countries such as China, the United States, Canada, Iran, and Saudi Arabia dominate production, supported by their abundant natural resources and advanced refining capabilities.

Despite promising growth, the industry faces challenges including environmental concerns related to extraction processes, supply chain constraints, and market volatility. Moving forward, sustainable practices, technological innovations, and efficient resource management will be essential to meet the rising global demand while minimizing environmental impact.

In summary, bitumen production is poised for steady growth, underpinned by global infrastructure development and evolving market trends, but must balance economic objectives with environmental. if you need more information be in touch with us.

FAQ About Bitumen Types

What percentage of global bitumen is used in road construction?

Around 90–92% of global bitumen production, which exceeds 100 million tons annually, is used in paving applications, mainly for road construction and maintenance.

How many types of bitumen are commonly used worldwide?

Globally, there are more than 7 main types of bitumen, including paving grade, oxidized, cutback, emulsified, polymer-modified, blown, and penetration grades, each serving different industries.

Which bitumen grade holds the largest market share?

Penetration grade bitumen dominates the market, covering nearly 70% of global usage due to its wide application in roads and highways.

How fast is the demand for polymer-modified bitumen (PMB) growing?

The PMB market is growing at a CAGR of 5–6%, with annual consumption surpassing 12 million tons, driven by high-performance road projects and airport runways.

How much oxidized bitumen is consumed annually?

Oxidized bitumen accounts for approximately 10–12% of total global consumption, with over 10 million tons used every year in roofing, waterproofing, and industrial applications.

What is the forecasted global market size of bitumen by 2030?

The global bitumen market is projected to reach over $120 billion by 2030, with paving grade bitumen remaining the dominant category.

How significant is emulsified bitumen in construction?

Emulsified bitumen makes up about 8–10% of global demand, with annual usage exceeding 8 million tons, particularly in cold and wet regions where rapid setting is required.

Which regions consume the most bitumen types?

Asia-Pacific leads with nearly 40% of global consumption, followed by North America at 25% and Europe at 20%, with paving grade dominating across all regions.

How much is the average penetration grade bitumen consumption in a highway project?

A standard 1-kilometer four-lane highway consumes around 3,000–3,500 tons of penetration grade bitumen, showcasing its massive role in infrastructure projects.

What is the estimated annual growth rate for specialty bitumen types?

Specialty grades like polymer-modified and emulsified bitumen are expected to grow by 6–8% annually, faster than traditional grades, due to demand for sustainable and durable road materials.

Bitumen Refinery

Asphalt in Modern Infrastructure

Bitumen Production An In-Depth Analysis

what are Bitumen types and grades?

Iran Bitumen